What covers do beauticians need?

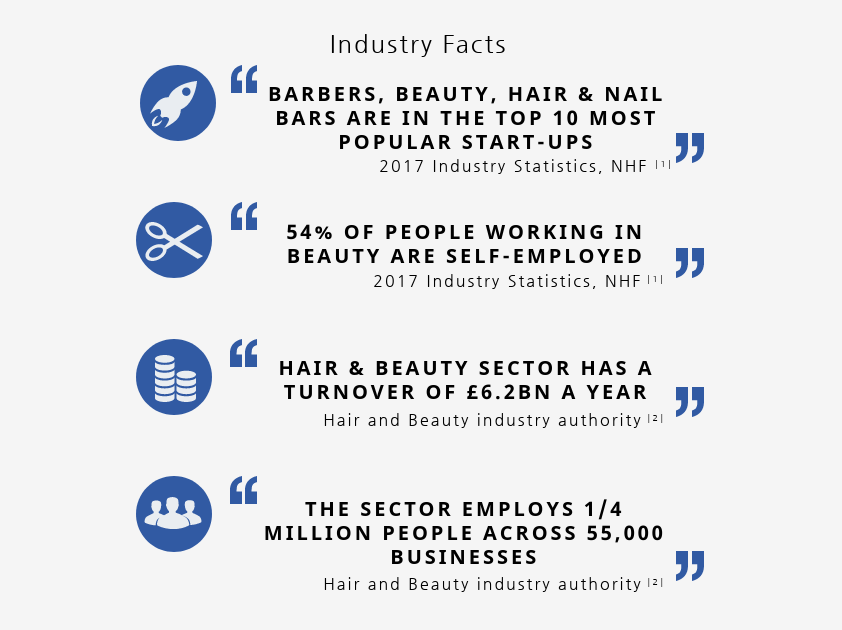

Beauticians are in increasing demand across the UK. Recent years have seen a significant increase in mobile beauty therapists and mobile hairdressers working out of hours and weekends to suit their own and more importantly their clients’ needs. Nail technicians in particular offer home visits and some rent space in a salon to take advantage of the footfall of an already established business.

Whether you’re mobile or working in a salon, there are a number of things that could go wrong along the way. Even the most simple of treatments could trigger a reaction, meaning you need insurance as essential protection. People who have never had any sensitivity to any kind of product could react due to a change in formula or even a lifestyle change.

The key to preventing these occurrences is to be vigilant with patch tests and stay akin to industry updates particularly with the brands and products that you champion.

While precaution is prudent for any beautician, reactions can still happen when you least expect. Thankfully these are few and far between, but even the most highly qualified and experienced beauticians may have witnessed an adverse reaction. Having the right insurance in place can give you peace of mind as well as financial security if something goes wrong.

Public Liability insurance

Taking out insurance for your business can help protect against the unexpected. Public liability insurance offers protection against accidental injury and damage to third party property and can often be extended to include the beauty treatments you offer. A customer could trip in your salon or fall over your equipment in their home meaning you could be liable for their injury.

Treatment cover

Innovation has taken the beauty industry by storm with numerous new treatments entering the market all the time. Keeping on top of trends as a beauty salon or hairdresser can give your business an edge and generate interest and loyalty amongst clients.

A reaction to a new ingredient in a product could cause burns or in extreme cases could trigger anaphylactic shock. Whatever you plan to do next, make sure your insurance protects you and that your treatment cover is geared up to cover all of the treatments you offer.

An insurance broker such as Premierline can advise you on the right level of cover and recommend a suitable beauty insurance policy to meet your needs.

Equipment cover

Whether you’re specialising as a nail technican, a mobile hairdresser or a beauty therapist, you will have accrued lots of kit and supplies that are instrumental to your business. Could you still visit clients or open your salon if your equipment was damaged or stolen?

By adding equipment or contents cover to your beauty insurance policy you can help minimise disruption to your business if something unexpected happens, letting you focus on providing your clients with the best service possible.

Business interruption

Having your own salon has many advantages; you can create a peaceful and soothing environment for your clients to relax and unwind while they enjoy being pampered. You could take advantage of your high street presence to attract customers and benefit from the footfall of passers-by as they shop. For the full time beautician this can be a great way to create a home for all things beauty for you and your clients.

But when something unexpected happens at your salon, whether it’s a smashed window or a leaking pipe, this relaxing environment could turn into a potential disaster. Business interruption insurance can help tide you over financially by covering your fixed expenses while you’re unable to trade. It could also help you relocate temporarily whilst your property is repaired.

Many businesses struggle to recover when disaster hits, and as many as 40% of businesses fail to reopen following a disaster because this cover is either overlooked or miscalculated. Don’t underestimate the power of business interruption; it could be the life saver of the business you’ve worked so hard to build up.

Employers’ Liability

Most self-employed beauticians work alone, especially those operating on a mobile basis. But did you know that if you employ people you’re legally required to have employers' liability insurance? If a member of staff suffers an injury at work this insurance can cover any compensation and legal expenses if they make a claim against you and your business is deemed to be at fault.

References:

[1] https://www.nhf.info/documents/industry-statistics-booklet/

Compare hair and beauty insurance

Premierline can help you compare hair and beauty insurance from a range of trusted insurers to help you find a great value beauty insurance policy for your business. You can compare quotes online in a matter of minutes or give us a call for expert advice and insurance recommendations for your business.