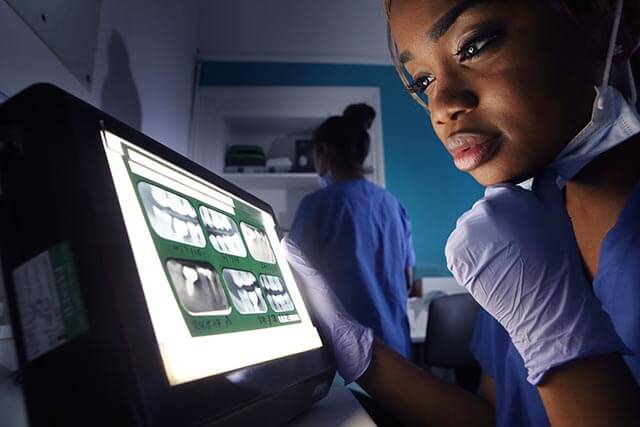

As a dental practitioner, you could be left exposed to a variety of risks. For example, a patient could injure themselves while visiting the dental practice or your premises could be damaged as a result of bad weather. In both of these scenarios, having the right insurance in place is essential for your dental practice.

As an insurance broker, we can arrange comprehensive insurance policies that are specifically designed to cater to the unique needs of dental practices. Whether you're a sole practitioner or running a group practice, we help find insurance options that can protect you against a wide range of risks and liabilities.

We understand that every dental practice is different, and that's why we work with you to create a customised insurance package that meets your specific needs. Our team of experienced insurance brokers will take the time to understand your business and provide you with tailored coverage options that fit your budget.

Don't let unexpected events disrupt your dental practice. Get in touch with us today to learn more about dental practice insurance and how we can help protect your business.