We understand the time constraints of running your own business and understand the exposures you face on a daily basis. That’s why we’ve made it easy for you to compare covers and prices online in a matter of minutes, taking the hassle out of arranging your indow cleaners insurance. However, if you're not sure what you need and would like some advice, call us today to speak to our business insurance advisors.

Window cleaners insurance can incorporate a number of covers that can be tailored to your individual requirements and is designed to offer protection for you, your clients and your staff. With such a variety of exposures from different locations, it’s essential for your business continuity that you have the right window cleaners insurance in place to protect your livelihood.

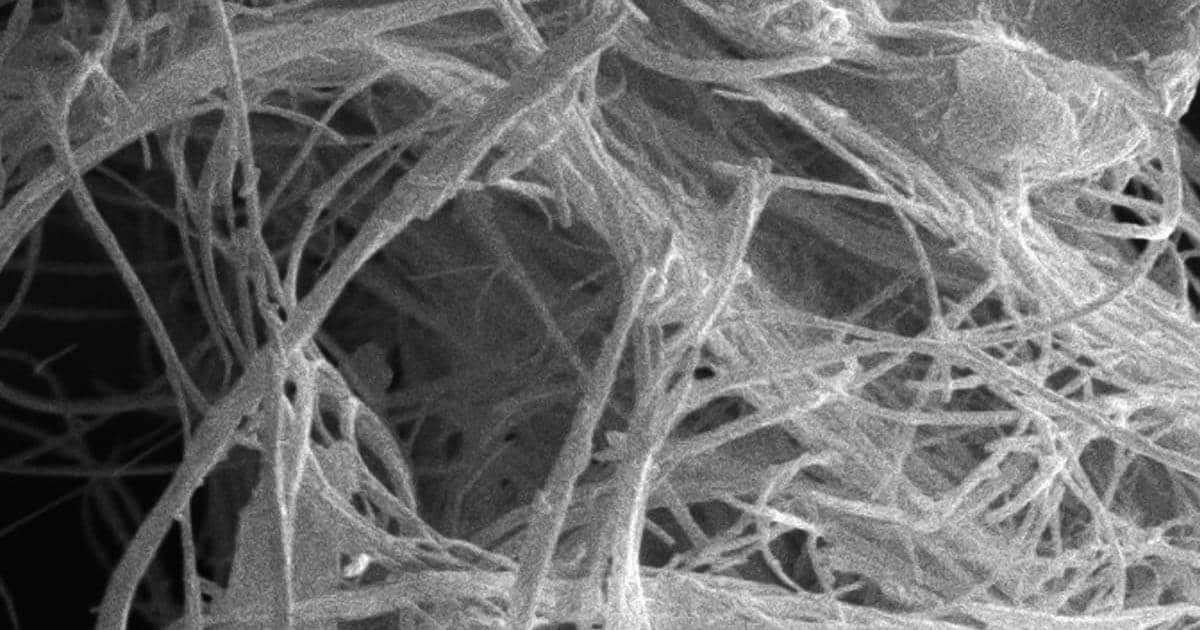

Your window cleaning insurance policy can be tailored to cover your individual business needs. Whether you are working on domestic or industrial premises, up ladders or using water-fed pole systems, you need to ensure that you have cover for everyone involved, should something go wrong.