You need comprehensive mobile beauty therapist insurance in case something goes wrong. With clients relying on your skill and expertise for special occasions or regular treatments protecting against the unexpected is essential.

Finding the right insurance for your mobile beauty business can be challenging and time consuming. With so many options, it can be difficult to know what’s best. That’s why we’ve made it easy to compare mobile beautician insurance quotes online from a panel of trusted insurers to find the cover that’s right for you.

We understand the pressure of running your own business can sometimes leave little time for much else. So we arrange flexible cover that’s tailored to your unique beauty therapy requirements.

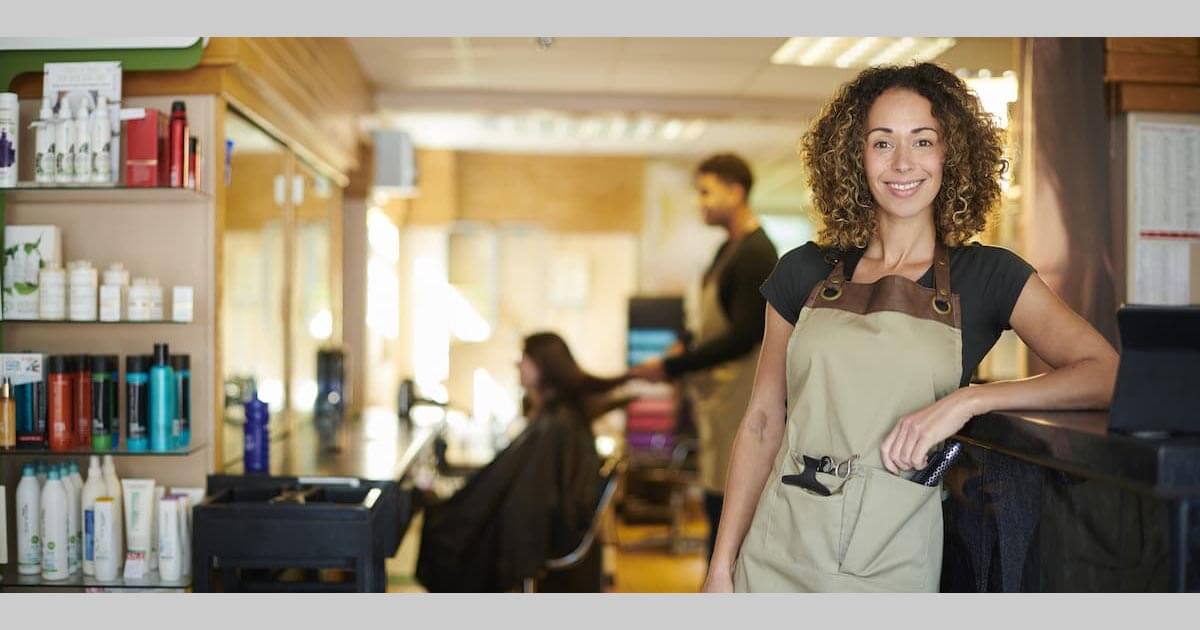

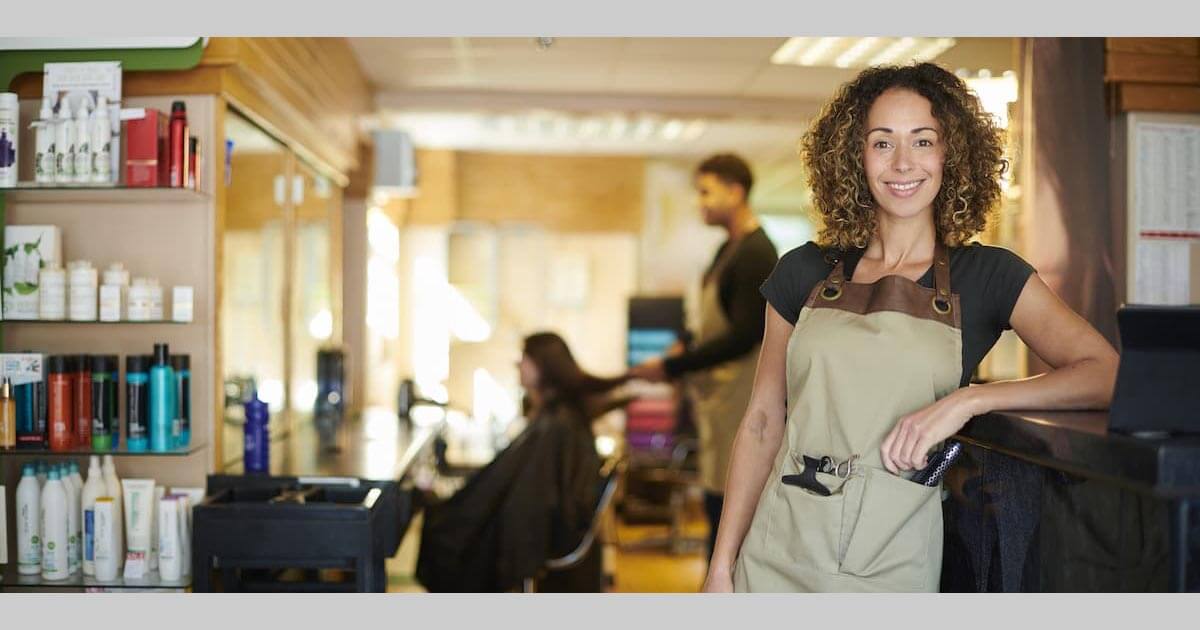

So if you know what you need you can compare quotes and protect your business online in a matter of minutes. If you’re running a salon or you’re a hairdresser, simply visit our beauty salon insurance or hairdressers insurance pages to compare quotes.