What does working from home cost and what can you claim for?

Your main costs

Rent or mortgage

Some of the cost of your rent or mortgage can be covered by your business, and you can work this out by calculating the amount of time you spend in each room.

Ideally, have a dedicated room that you will only use for your business such as a home office. However, you will need to pay a Capital Gains Tax on any room used for business if you sell your house, so it is best to restrict the number of rooms that you use for this purpose.

Council tax

Your council tax will vary depending on the valuation band of your property and the rates set by your local council.

You will be able to claim a percentage of your council tax back if you use your house for business use. Get in touch with your local council to find out more information about how you can claim this back.

Insurance

If you already have home insurance, it is unlikely that this will cover your home for business use and you may need working from home insurance. Get in touch with your broker or insurer to find out if your policy covers your contents and building for business use.

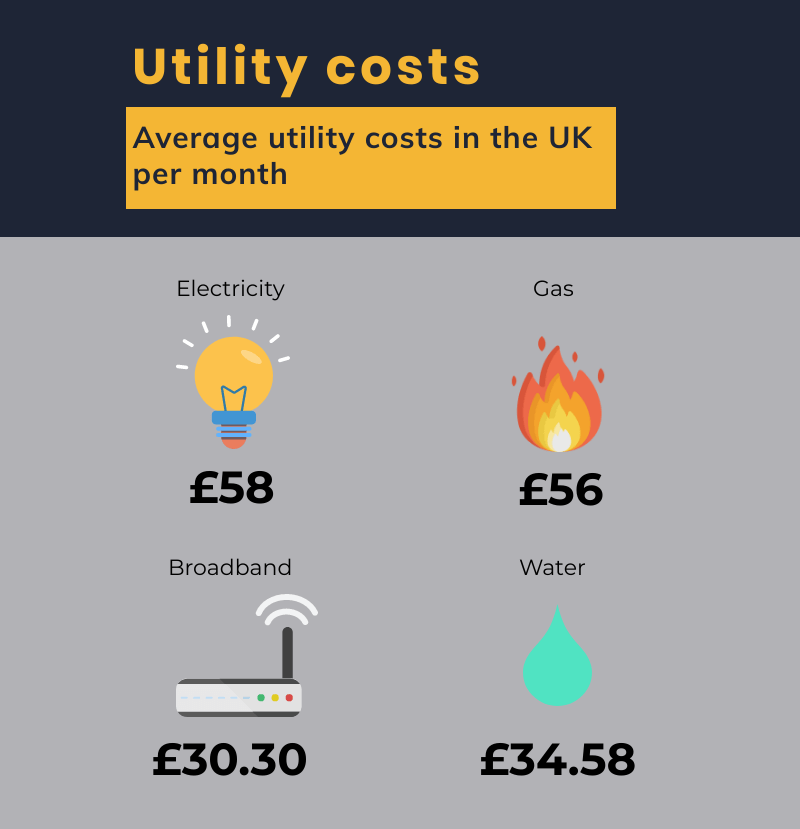

Calculating utility costs

Here are some of the average monthly costs in the UK for your key utility bills:

- Electricity - £58

- Broadband - £30.30

- Gas - £56

- Water - £34.58

You may be able to claim some of your bills back as a tax deductible from the Government if you use your own property as a business premises, but only the parts that are used for business. Work this out with some help from our infographics below.

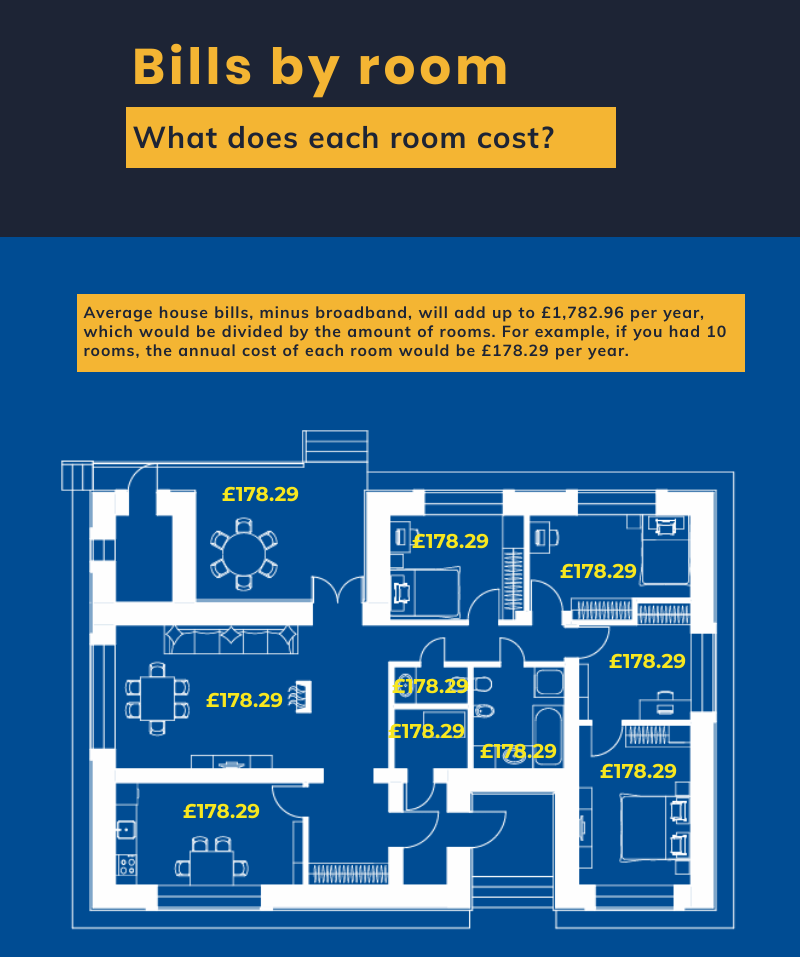

Bills by room

You can work out how much each room will cost you in utilities, simply by dividing your monthly or quarterly bill by the number of rooms that you have.

However, you will need to use a different method to calculate business use for your broadband. We’ll get to this later. Using the average prices above, minus broadband which needs to be calculated separately, the total average costs per year would add up to £1,782.96, so dividing this by the number of rooms in your house would give you the cost per room. If you had 10 rooms in your house, each room would cost you £178.29 per room, per year.

Calculating your broadband

Calculating the cost of your broadband and phone line is similar to calculating the percentage of your utility bills, where you will need to calculate how many of your phone calls are used for business use, because you won’t be able to claim a portion of the line rental because that would already need to be installed for your home use.

If you installed your broadband solely for business use, you would need to be able to prove that somehow.

Again if we use the UK average for broadband costs, and you found that you use your phone for 50% business use, the business cost of your phone line would be £15.15 a month.

Calculating your rental or mortgage costs

Self-assessment business expenses

When filling in your HMRC self-assessment form, you may be offered the chance to use simplified expenses if you are a sole trader.

Flat rate alternative

You can use the flat rate alternative to claim back for working from home or living at your business premises. To do this, you will need to keep track of your home business usage, as outlined above, or how many people live on your business premises.

Freelancers insurance with Premierline

Freelance work can cover a huge variety of different roles in different industries, and as such, needs a robust insurance policy that suits you and your business.

At Premierline, our insurance experts can advise you on the insurance covers that will protect you and your livelihood, so whether you require home business insurance or consultants insurance get in touch to compare business insurance quotes.