Property damage

Whether you own or rent the premises that you work from, there are risks that you face to the property.

Building, signage, shop windows, merchandise and equipment are all things that can be damaged and could cost large sums of money to repair. Many different people could cause damage to your property, either intentionally or unintentionally. Regardless, the damaged property needs to be repaired or replaced at a cost to you.

Depending on what you want to cover, consider business contents or commercial building insurance to protect your business.

Equipment failure

As a retail business, you may rely on certain pieces of equipment, such as computers, electronic point of sale (epos) systems, refrigeration or cooling systems.

Items like these can break down at a moment’s notice, and again, can be costly to replace or repair. The equipment that you use for your business could also be covered under a contents insurance policy.

Criminal activity

The most recent crime report from the Association of Convenience Stores showed that 60% of retailers had experienced theft.

Theft is one of the main crimes that affect the retail sector, but these businesses can also be victims of fraud and online scams.

Public liability

Any time that a member of the public visits your shop, you are exposed to a public liability risk.

Slips, trips and falls can lead to claims against your business, but your equipment and unauthorised access to staff-only areas can also be a cause for concern.

Protect your business from claims arising from the public with public liability insurance cover.

Employers’ liability

The people that you employ in your store are essential to your day to day activities but are also a source of risk for your business.

Workplace accidents such as slips, trips and falls and repetitive strain injuries can all lead to claims against your business, but there are also activities such as manual handling and ladder climbing that could lead to serious injury.

You can cover your business against claims from employees with an employers' liability insurance policy.

Product liability

Selling goods to customers is the bread and butter of your business. However, whilst you may work hard to ensure that your products are safe for customers, mistakes can still happen.

If a product that you sell harms a customer or damages their property, you could be liable for a claim which could lead to costly legal procedures.

Product liability insurance is a policy that could protect you in the event that a customer is injured or their property is damaged because of one of your products.

Business interruption

There could be many reasons that your business could suffer an interruption to activities; a period of time when you are unable to trade. During this time, you won’t be making any money, making running your business more stressful.

Business interruption could be caused by a fire, flood, cyber incident; product recalls or supply chain issues that cause you to close your business for some time. A business interruption could happen to any business and can be costly when it comes to getting your business back up and running.

Consider business interruption insurance to help you rebuild your business following a business interruption.

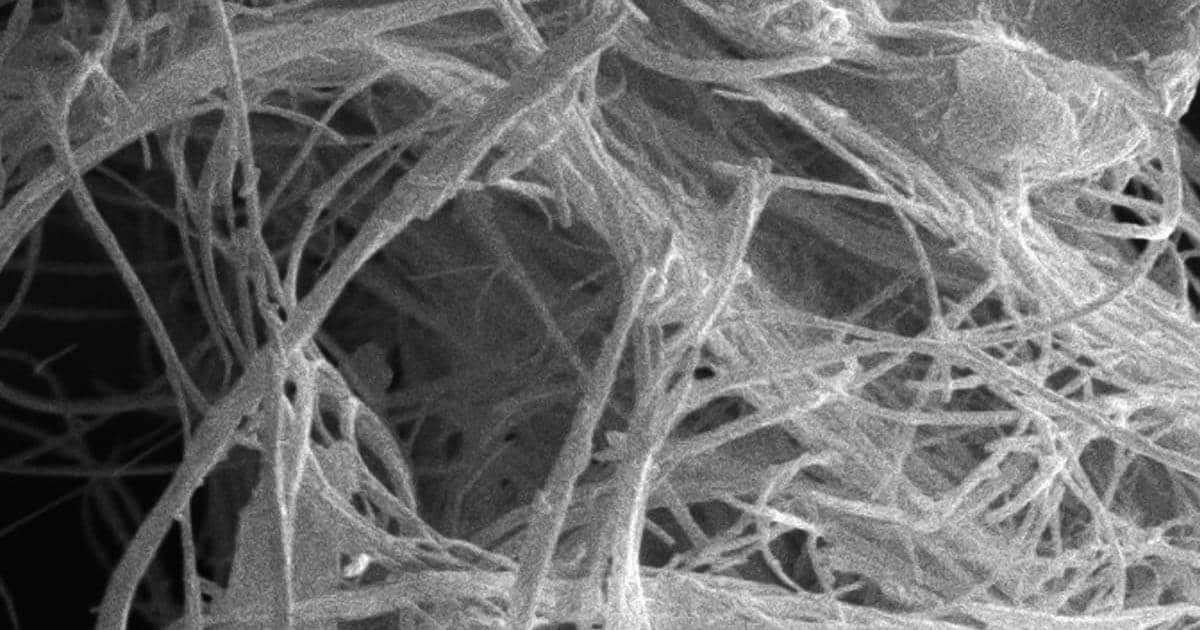

Cyber attack

As a retail business, you are a target for cybercriminals who may be looking to steal your customers’ payment details.

If you use a computer to run your business, you could be susceptible to ransomware attacks, malware, viruses and phishing scams, all of which could lead to costly legal cases, business interruption and damage of your business’ reputation.

Cyber insurance is one of the most undervalued insurance covers available, but in a world where technology is making us more and more connected, it has never been more important to cover your digital world.

Vehicle risks

If you use a vehicle for your business operations, you create motor vehicle exposures for your business.

Improper use of a vehicle can lead to accidents and injuries for you, your staff or members of the public, potentially making you liable for a claim.

Third-party vehicle insurance is the legal minimum level of cover that you must have if you are driving on roads in the UK, however, if you use your vehicle for business use, you may want to consider higher levels of cover. Take a look at our commercial transport insurance for more information.