Perhaps, one of the most famous opening paragraphs written by the great Charles Dickens – the first few lines of A Christmas Carol, a story about a business owners loss, his discovery and of course, Christmas.

Let us set the scene; in the story Jacob Marley and Ebeneezer Scrooge were proprietors of a firm called Scrooge & Marley. The story begins with a brief introduction into the death of Marley, which sets off a series of events during which Scrooge is visited by four ghosts – the spirit of Jacob Marley himself, followed by the Ghost of Christmas Past, the Ghost of Christmas Present and the Ghost of Christmas Yet to Come.

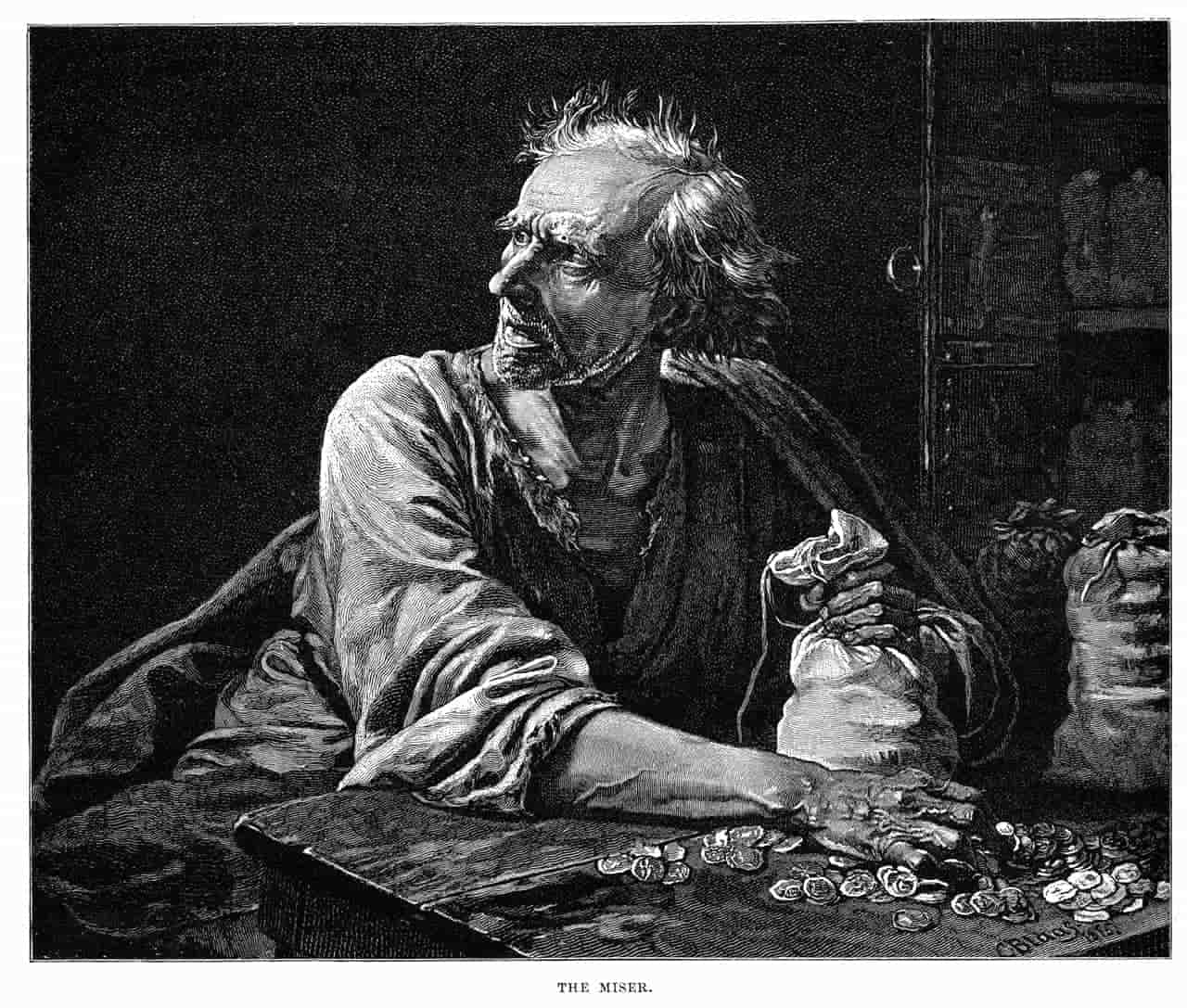

Scrooge is considered to be a selfish man, he refuses to help the poor or give money to charity and also refuses to spend time with family at Christmas, he’s so focused on running his business and turning a profit that it becomes an obsession at the expense of those around him. The death of his business partner Marley changes everything, no doubt putting additional pressure on Scrooge to continue to make their business a success even without the help of his business partner and friend, driving him even further into his world of selfishness.

Perhaps the pair should have considered key person insurance, which can be taken out to cover the business against financial losses which could occur as a result of the death or serious illness of a key person.

Could the peace of mind provided by a quality insurance cover have taken the stress away from Scrooge in the wake of Marley’s death? Giving him better opportunity to reflect on the more important things in life?

Perhaps even, with better clarity, there would be no need for the ghosts to come and visit him in the first place?